In today’s fast-paced world, the idea of earning money while you sleep has become an alluring prospect for many. Passive income is a financial strategy that allows you to generate revenue with minimal day-to-day involvement. From investing in real estate to creating digital products, there are countless avenues to explore. This article will delve into some of the most effective and easy ways to make passive income this year, especially for those who are tech-savvy and ready to leverage their skills.

Understanding Passive Income

Before diving into the methods, it’s essential to understand what passive income entails. Unlike active income, where you exchange time for money (like a traditional 9-to-5 job), passive income streams require initial effort and investment but can generate revenue over time without ongoing work.

Types of Passive Income

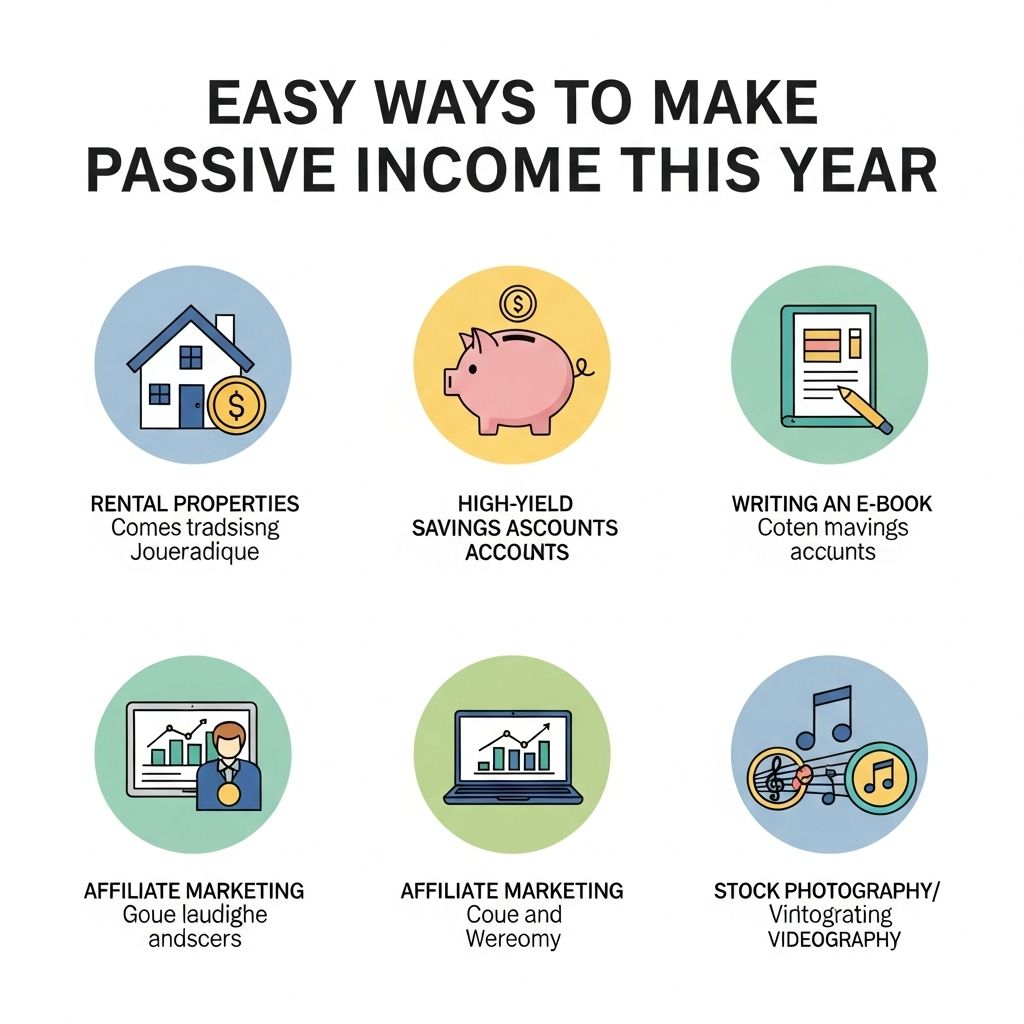

There are various types of passive income streams, including:

- Investments: Stocks, bonds, and mutual funds that earn dividends.

- Real Estate: Rental properties or real estate investment trusts (REITs).

- Digital Products: E-books, online courses, and digital downloads.

- Affiliate Marketing: Earning commissions by promoting other companies’ products.

Investing in Dividend Stocks

Investing in dividend-paying stocks is a classic method of earning passive income. Many companies distribute a portion of their profits to shareholders in the form of dividends. Here’s how to get started:

- Research: Identify companies with a strong track record of paying dividends.

- Open a Brokerage Account: Use platforms such as Fidelity, Robinhood, or E*TRADE.

- Create a Diversified Portfolio: Invest in various sectors to minimize risk.

Pros and Cons of Dividend Stocks

| Pros | Cons |

|---|---|

| Potential for high returns | Market risk can affect stock value |

| Regular income through dividends | Requires market research and monitoring |

Real Estate Investment Trusts (REITs)

If managing a rental property seems daunting, consider investing in REITs. These are companies that own, operate, or finance income-producing real estate, and they typically pay out most of their taxable income as dividends.

Getting Started with REITs

Follow these steps to invest in REITs:

- Choose a reputable brokerage that offers REITs.

- Research different types of REITs: equity, mortgage, and hybrid.

- Invest in a diversified mix to balance risk and return.

Creating Digital Products

In the digital age, creating and selling digital products is a viable source of passive income. This could include e-books, courses, or software tools. Here’s how to get started:

Steps to Create Digital Products

- Identify Your Niche: Choose a subject that you’re knowledgeable about and passionate for.

- Create Quality Content: Develop your e-book or course materials, ensuring they provide real value.

- Choose a Platform: Use sites like Udemy for courses or Amazon Kindle for e-books.

Marketing Your Digital Products

Once your product is ready, marketing it effectively is crucial:

- Utilize social media platforms to reach a broader audience.

- Implement email marketing campaigns to target potential customers.

- Consider leveraging affiliate marketing to incentivize others to promote your product.

Affiliate Marketing

Affiliate marketing involves promoting third-party products and earning a commission for each sale made through your referral link. This method can be highly lucrative if executed correctly.

Steps to Start Affiliate Marketing

- Choose a Niche: Focus on a specific area that aligns with your interests or expertise.

- Join Affiliate Programs: Sign up for programs like Amazon Associates, ClickBank, or ShareASale.

- Create Content: Develop a website or blog to review and promote products.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms allow you to loan money to individuals or small businesses in exchange for interest payments. This option can provide higher returns than traditional savings accounts.

Getting Started with P2P Lending

- Research reputable P2P lending platforms like LendingClub or Prosper.

- Diversify your loans across multiple borrowers to mitigate risk.

- Monitor your investments and adjust your strategy as needed.

Conclusion

Generating passive income is not only an attainable goal, but it can also lead to financial freedom if approached wisely. While each method requires an initial investment of time, effort, or capital, the rewards can be substantial. Whether you choose to invest in stocks, create digital products, or explore affiliate marketing, the key is to start today and stay committed to your financial growth.

FAQ

What are some easy ways to make passive income?

Some easy ways to make passive income include investing in dividend stocks, real estate crowdfunding, peer-to-peer lending, creating an online course, and earning royalties from creative works.

How much money can I make from passive income?

The amount you can make from passive income varies widely depending on your investment, the method you choose, and market conditions. Some people earn a few hundred dollars a year, while others generate thousands.

Is passive income truly ‘passive’?

While passive income can require less ongoing effort than traditional jobs, it often requires initial time, investment, or effort to set up. After the setup, it can generate income with minimal management.

What are the risks associated with passive income investments?

Risks include market volatility, potential loss of capital, changes in regulations, and the possibility of not receiving returns if the investment does not perform as expected.

Can I start earning passive income with little money?

Yes, there are several options to earn passive income with little money, such as high-yield savings accounts, micro-investing apps, and affiliate marketing through a blog or social media.